Are you prepared to take control of your money future? Unleashing your smart wealth potential starts with a specific vision for your targets. It involves wise decision-making and a commitment to development dive deeper in the realm of personal finance. By enabling yourself with knowledge and adopting effective strategies, you can elevate your wealth potential and achieve lasting financial prosperity.

- Start by identifying your short-term and long-term goals.

- Investigate different investment opportunities that align with your risk tolerance and financial profile.

- Engage professional advice from a certified financial planner to construct a personalized wealth management strategy.

Developing Wealth Habits for a Life Well-Lived

Wealth isn't merely about amassing resources; it's about creating a life of abundance. To achieve this, cultivating positive wealth habits is crucial. Start by adopting a mindset of growth. Focus on expanding your financial literacy and seek opportunities to grow your wealth.

- Cultivate a budget that records your income and expenses.

- Schedule regular savings and investments.

- Live below your means, avoiding unnecessary expenditures.

Remember, true wealth is a journey, not a destination. By implementing these habits consistently, you can pave the way for a life well-lived and achieve lasting financial security.

The Intelligent Investor's Guide to Lifestyle Design

For the discerning investor, wealth accumulation is merely the foundation. The true art lies in leveraging financial success to architect/construct/build a lifestyle that enhances/amplifies/maximizes well-being. This requires a mindful approach, blending prudent investment strategies with deliberate choices about time allocation/how you spend your time. It's about cultivating a life that is both meaningful and fulfilling/rich and rewarding/purposeful and joyful, free from the anxieties of financial uncertainty.

- Start by defining/Begin with identifying/Clearly outline your core values and aspirations. What truly matters to you? Is it creative pursuits? Understanding your driving forces will guide your decisions and help you sync your investments with your lifestyle goals.

- Develop/Cultivate/Foster a long-term perspective. Building a fulfilling life is a marathon, not a sprint. Patience and discipline are key to both investing and personal growth. Avoid the allure of quick gains/returns/windfalls and instead focus on sustainable/lasting/enduring success.

- Embrace/Utilize/Leverage your financial resources to create opportunities for meaningful experiences. This could involve travel, education, or simply spending more time with loved ones. Remember, the goal is not merely to accumulate wealth, but to allocate it in ways that enrich your life.

Ultimately/In essence/At its core, the intelligent investor's guide to lifestyle design is about living a life of intention and purpose. It's about using financial wisdom to create a future that is both secure and prosperous/vibrant and fulfilling/rewarding and meaningful.

Taming Your Finances

Achieving financial well-being is a journey that requires focus. It's about cultivating healthy routines and embracing sound financial principles. By understanding the basics of budgeting, saving, investing, and debt management, you can equip yourself to make informed decisions that foster your long-term aspirations.

- Initiate by tracking your income and expenses to gain a clear understanding of your financial position.

- Define realistic budgetary goals that are meaningful to you.

- Investigate different portfolio options to grow your wealth over time.

Remember, financial literacy is an continuous endeavor. Stay educated about market trends and seek with financial advisors as needed.

Building a Wise Money Lifestyle: Tactics for Long-Term Success

Cultivating a financially secure future hinges on establishing smart money habits that foster long-term growth. This involves integrating a mindful approach to managing your resources, focusing on debt elimination, and spreading your wealth across multiple avenues. By incorporating these principles, you can pave the way for a more secure financial course.

- Explore creating a thorough budget to record your income and expenses. This will offer valuable knowledge into your spending patterns.

- Schedule regular savings transfers to build a healthy emergency fund, ideally comparable three to six months of living expenses.

- Consult with a qualified financial advisor to design a personalized investment strategy aligned with your goals.

Boost Your Wealth

Ready to take control of your money matters? Making smart strategies today can significantly impact your future financial security. Start by analyzing your income and expenses. This will give you a accurate understanding of where your money is going. Next, consider side hustles. Saving diligently are also crucial steps towards achieving greater wealth. Remember, it's never too early or too late to enhance a solid financial foundation.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Amanda Bynes Then & Now!

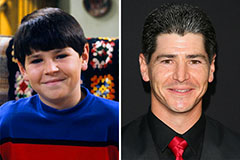

Amanda Bynes Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now!